Homestead Exemptions FLORIDA HOMESTEAD EXEMPTION OFFICIAL TIMELY FILING PERIOD JANUARY 1 – MARCH 1

https://www.leepa.org/Exemption/GeneralExemptionInfo.aspx

LATE FILED APPLICATIONS ACCEPTED UP TO 25 DAYS AFTER THE MAILING OF THE TRUTH IN MILLAGE NOTICE (TRIM Notice) – If you believe you may qualify – apply immediately.

Florida law requires that application be made by March 1st (late filed accepted and processed in accordance with current Florida law) to be eligible for up to a $50,000 Homestead Exemption. Only new applicants or those who had a change of residence need apply. Automatic renewals are mailed in January each year.

Homestead Exemption is a constitutional benefit of up to a $50,000 exemption removed from the assessed value of your property. It is granted to those applicants who possess title to real property and are bona fide Florida residents living in the dwelling and making it their permanent home on January 1. Documentation that proves you were a resident at the homestead property is required.

Rental of the Homestead Property Property owners who receive the homestead exemption on their residence need to be aware that personally renting their property or renting through home-sharing or collaborative consumption companies may constitute abandonment and, therefore, loss of the homestead tax exemption. Renting typically means exclusive use by a tenant on a temporary, seasonal or annual basis. If you plan to rent, please contact the appropriate legal advisers to be sure that you do not jeopardize your homestead exemption. Relinquishing your homestead exemption will increase your property taxes.

Value Limitations (caps) Properties granted homestead exemption automatically receive the “Save Our Homes” benefit. This is a constitutional benefit approved by the Florida voters in 1992. It places a limitation of 3% on annual assessment increase on homestead properties beginning with the 1995 tax year. For properties granted homestead exemption in the prior years, that assessed value will be the base value for the implementation of “Save Our Homes". Thereafter, the assessed value will not increase more than 3% or the Consumer Price Index, whichever is less. Exceptions to that limitation include new additions or construction that escaped taxation in the past. When a homestead property sells, the assessed value returns to fair market value in the year following the sale. That value assessment then becomes the new owner/homestead applicant’s base value for “Save Our Homes” purposes. More information on the Consumer Price Index (CPI) is available from the Department of Revenue.

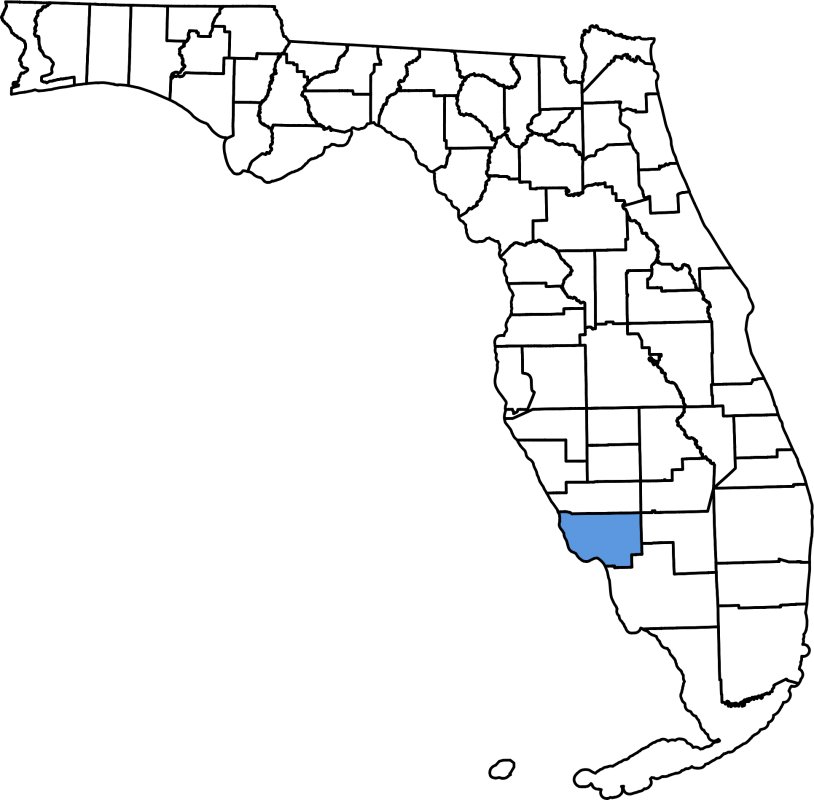

You may file for your homestead exemption by mail, in person or on-line at www.leepa.org. If filing online, please read on-line filing instructions carefully to determine eligibility. If you are filing by mail, you may download an application form, complete same, attach required documentation and mail the form to our office. If you are not a registered voter and cannot provide a photocopy of your recorded Declaration of Domicile, you must visit the Appraiser’s office to complete this form for recording. Contact info: E-mail: Exemptions@leepa.org, Phone: (239) 533-6100, physical location: Constitutional Complex, 2480 Thompson St, 4th floor, Fort Myers Florida 33901 between the hours of 8:30 a.m. and 5:00 p.m. Monday through Friday.

Those individuals whose names appear on the deed and who reside on the property as of Jan. 1 and who are bona fide Florida residents as of January 1 are eligible to file. Seasonal or temporary rental of the homestead may be considered abandonment of the homestead exemption – contact the PA Office for information.

* Regardless of the type of tenancy, it is recommended that all persons whose names appear on the deed and reside on the property apply for the exemption to safeguard your benefits from ownership changes in the future due to death, divorce or other changes. Properties that are used as rental property (seasonal or annual) do not qualify as homestead property. Please contact the appraiser for more information on rentals.

It is the responsibility of every taxpayer to annually verify their exemption / SOH portability status and notify the Appraiser of any corrections. The Notice of Proposed Taxes (TRIM Notice) mailed each year in mid-August documents your exemption and SOH status. Review your exemption and/or portability status on the Notice of Proposed taxes. If your exempt status is not documented on the Notice, contact our office immediately. Failure to provide all qualifying documentation no later than the deadline stated on the TRIM Notice will result in the loss of your exemption / SOH benefit for the current tax year. Exemptions are not granted retroactively and are not automatically transferred to your new homestead. You must apply for exemption and portability of the SOH benefit (if applicable) any time you purchase and relocate to a new residence. Please govern yourself accordingly. ** The “Date of Occupancy” is required and is used to determine eligibility. Date of occupancy isn’t necessarily determined by closing date on your new property or sale date of your prior residence or the date you make application for exemption. Date of occupancy is the date you reside on the property and consider the property to be your permanent and primary residence; issuance of your driver’s license and voter registration at the homestead address also prove your physical presence as of a specific date and are used in determining your eligibility.

To better serve the residents of Lee County, we are now accepting Homestead Exemption applications by mail. The letter of instruction and application form may be obtained by visiting our website at: www.leepa.org. If you prefer to apply in person, you may do so at our Main Office located at 2480 Thompson Street, 4th floor, Fort Myers, Florida between the hours of 8:30 a.m. and 5:00 p.m. Monday through Friday. You may submit your application by mail. Be sure to include all required documentation and information at the time you mail your application. Incomplete applications cannot be processed and will be returned to you for completion. Mail your application to Lee County Property Appraiser, P O Box 1546, Fort Myers, Florida 33902. Timely filed applications must be postmarked no later than midnight, March 1, of the year in which you qualify for exemption. You may late file applications which will be processed in accordance with Florida Statutes. If you believe you may qualify, please file your application immediately.

To apply in person you must apply at 2480 Thompson Street, 4th Floor, Fort Myers, Florida 33901. Please be sure that you have all the required documentation/information with you when you visit our office to apply. Hours of operation are 8:30 A.M to 5:00 P.M, Monday through Friday. The Office of the Property Appraiser is closed in observance of scheduled holidays as per the Board of Lee County Board of County Commissioners. Please refer to our "List of Observed Holidays" on the home page of our website at www.leepa.org.

The Lee County Tax Collector's Office does not provide exemption application forms and cannot assist you in filing an exemption.

If you hold title to a mobile home and the land on which it is situated and the mobile home is permanently affixed to the land, you can make application to the Property Appraiser to have the property appraised as real property. This application requires you to purchase an "RP" sticker from the Tax Collector’s Office. You must make application for the sticker between January 1st and March 1st. Homestead exemption may be allowed if the mobile home meets the above qualifications and the property owner meets the qualifications for the exemption.

When no one individual owns the land, as is the case with some mobile home parks, the park is taxed for the land as a whole (real property) and the improvements to the mobile home are taxed as Tangible Personal Property. However, you still must buy a yearly "MH" tag for the mobile home itself from the Tax Collector’s Office.

An agricultural classification is the designation of land by the Property Appraiser, pursuant to F.S. 193.461, in which the assessment is based on agricultural use value.

To qualify for Agricultural classification, a return must be filed with the Property Appraiser between January 1 and March 1 of the tax year. Only the land that is used for a bona fide agricultural purpose shall be classified agricultural. "Bona Fide Agricultural Purposes" means good faith commercial agricultural use of the land.

The Property Appraiser, prior to classifying such lands, may require the taxpayer or the taxpayer’s representative to furnish such information as may reasonably be required to establish such lands are actually used for a bona fide agricultural purpose.

The Property Appraiser may deny agricultural classification to the following lands:

Florida provides two avenues of property tax relief for conservation easements, environmentally endangered lands, and other conservation areas that retain the natural landscape and ecosystem. The first is a conservation land Classification. The second is a property tax Exemption.

To qualify for either the classification or the exemption, an application must be filed with the Property Appraiser between January 1 and March 1 of the tax year.

Any person who knowingly and willfully gives false information for the purpose of claiming homestead exemption is guilty of a misdemeanor punishable by up to one (1) year in prison and/or a $5,000 fine. 196.131, F.S.

Send exemption questions to Exemptions@leepa.org